Orbiter Finance™ | Bridge | Official Site

Orbiter Bridge: A Comprehensive Overview

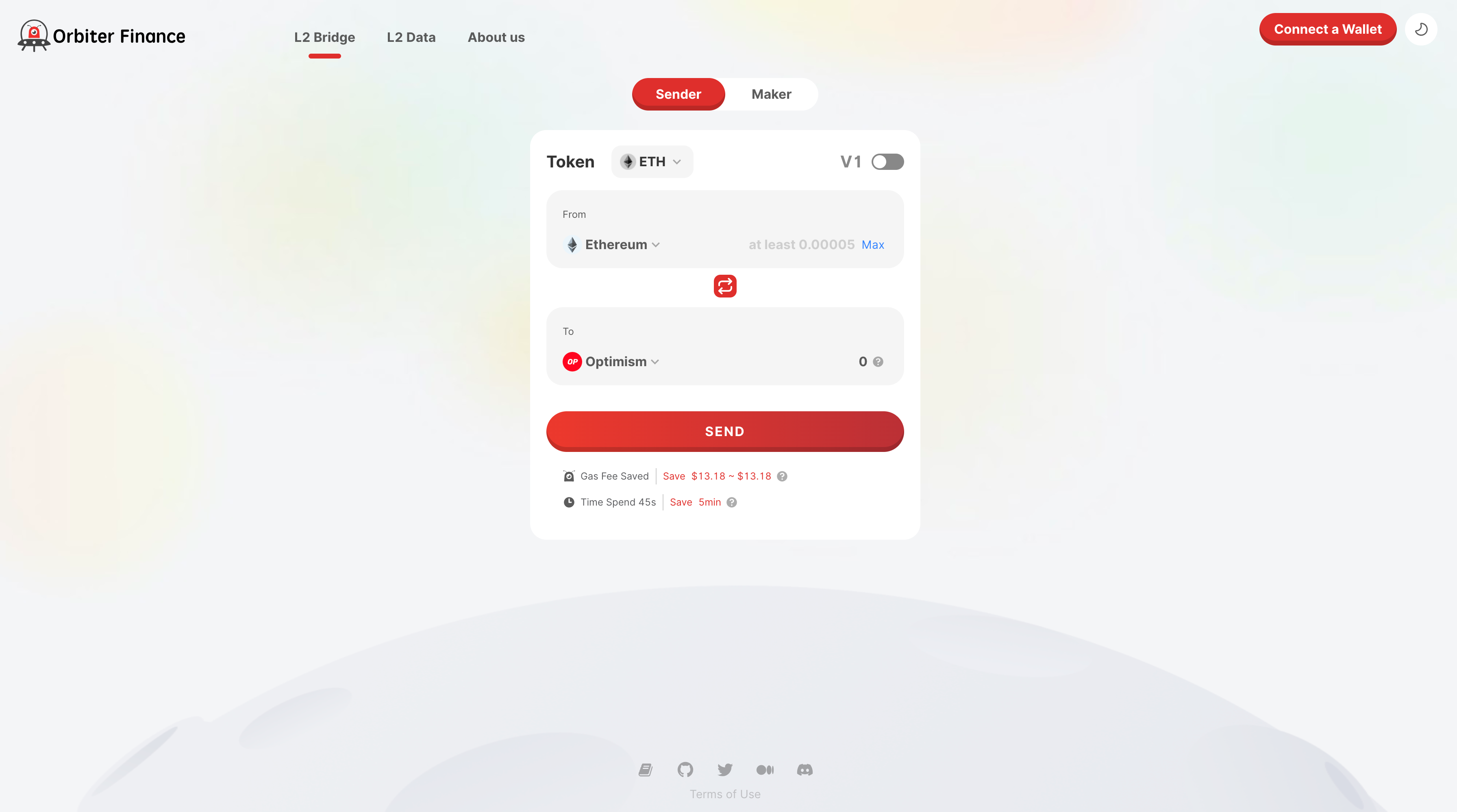

Orbiter BridgeOrbiter Bridge is a decentralized, cross-rollup bridge that enables seamless asset transfers between Ethereum-based Layer 2 (L2) networks. It is designed to provide a secure and efficient way for users to move their digital assets across different Ethereum scaling solutions, allowing them to take advantage of the unique features and benefits offered by each L2 network.

Understanding the Orbiter Bridge

At its core, Orbiter Bridge is a cross-chain liquidity protocol that utilizes a network of "Makers" to facilitate asset transfers. These Makers are entities that provide liquidity on the supported chains, allowing users to deposit tokens on one chain and withdraw the corresponding tokens on the destination chain.

The key components of the Orbiter Bridge system are:

Maker Accounts: Orbiter Bridge relies on a set of permissioned Maker accounts, each dedicated to a specific token (e.g., ETH, USDC, USDT, DAI). These Maker accounts hold the liquidity that users can access when making cross-chain transfers.

Proxy Contracts: The Orbiter Bridge system includes proxy contracts that handle the transfer of funds into the Maker accounts when users interact with the bridge using the custom frontend or SDK.

Validation: Currently, the Orbiter Bridge system relies on the trust that the Orbiter team will ensure the Makers disburse the required tokens on the destination chain after receiving the user's deposit on the source chain. However, the team has plans to deploy a set of contracts that will require independent Makers to post bonds as a safeguard against not meeting their obligations.

How Orbiter Bridge Works

The process of using the Orbiter Bridge can be summarized as follows:

Deposit: A user deposits tokens (e.g., ETH, USDC, USDT, DAI) into the Maker account on the source chain.

Transfer: The Orbiter Bridge system then transfers the user's tokens from the Maker account on the source chain to the Maker account on the destination chain.

Withdrawal: The user can then withdraw the corresponding tokens from the Maker account on the destination chain.This process is facilitated by the Orbiter Bridge's proxy contracts, which handle the transfer of funds into the Maker accounts on behalf of the user.

Potential Risks and Limitations

While the Orbiter Bridge aims to provide a secure and efficient cross-chain asset transfer solution, there are some potental risks and limitations to be aware of:

Trust in Makers: Currently, the Orbiter Bridge system relies on the trust that the Orbiter team will ensure the Makers disburse the required tokens on the destination chain. This introduces a centralized point of failure, as the system is dependent on the Orbiter team's integrity and reliability.Funds Theft: If a selected Maker decides to misuse the user's funds, it could result in the theft of those funds, which is a critical risk.Funds Freezing: If a selected Maker does not act on the user's deposit, it could lead to the freezing of the user's funds, which is also a critical risk.User Censorship: If a selected Maker does not act on the user's deposit, it could result in the censorship of the user, which is another critical risk.Lack of Independent Makers: Currently, only the Orbiter team is acting as Makers, which limits the decentralization and reslience of the system.Future Developments and Improvements

To address the potential risks and limitations of the current Orbiter Bridge system, the Orbiter team has plans to implement several improvements:

Independent Makers: The team plans to deploy a set of contracts that will require independent Makers to post bonds as a safeguard against not meeting their obligations. This will help to decentralize the system and reduce the reliance on the Orbiter team.Automated Monitoring and Enforcement: The team is working on developing automated mechanisms to monitor the performance of Makers and enforce their obligations, reducing the risk of funds theft, freezing, and user censorship.Increased Transparency: The Orbiter team has expressed a commitment to increasing the transparency of the system, potentially by publishing regular audits and reports on the bridge's operations and performance.Expanded Chain Support: The Orbiter team aims to expand the number of supported chains, allowing users to transfer assets across a wider range of Ethereum-based L2 networks.Conclusion

Orbiter Bridge is a promising cross-rollup bridge that aims to provide a secure and efficient way for users to move their digital assets across different Ethereum scaling solutions. While the current system relies on the trust in the Orbiter team and the Makers, the team's plans to introduce independent Makers, automated monitoring, and increased transparency suggest a commitment to addressing the identified risks and limitations.

As the Ethereum ecosystem continues to evolve and the demand for cross-chain interoperability grows, solutions like Orbiter Bridge will play an increasingly important role in facilitating the seamless movement of assets across different L2 networks. However, it is crucial for users to carefully evaluate the risks and limitations of the system and stay informed about the ongoing developments and improvements.

1. Why Buy Orbiter Bridge?

There are several reasons why investors may consider buying Orbiter Bridge:

1. Discounted Price:

Investors who purchase $SMOG on Ethereum during the presale period can enjoy a 10% discount, providing an immediate unrealized gain.2. Airdrop Potential:

Orbiter Bridge has set aside 35% of its total supply for airdrops, generating significant hype and offering the opportunity for token holders to receive additional tokens.3. Staking Rewards:

Investors who buy $SMOG on Ethereum can stake their tokens and earn a substantial 42% APY, enhancing their returns from holding the meme coin.4. Future Airdrops and Burns:

The Orbiter Bridge team has hinted at the possibility of future airdrops and token burns, which could further increase the value and scarcity of $SMOG.5. Staking and Rewds

One of the key features of Orbiter Bridge is the ability for users to stake their TIME tokens and earn rewards. Stakers can earn attractive rewards through the protocol's high Annual Percentage Yield (APY). The rewards are funded by minting new TIME tokens, which are distributed to stakers based on their stake in the protocol. This incentivizes users to hold and stake their TIME tokens, contributing to the stability and growth of the protocol.

6. Minting and Treasury Contributi

In addition to staking, users can also participate in minting TIME tokens. Minting involves selling certain assets, such as TIME-MIM liquidity pooland wrapped AVAX, to the Wonderland protocol. Minters receive newly minted TIME tokens at a discounted price, contributing to the protocol's treasury balance. The growing treasury balance allows Wonderland to increase the backing per TIME token and sustain high reward APYs for stakers.

7. Governance and Participation

Orbiter Bridge holders also have the opportunity to participate in the governance of the protocol. Through their TIME tokens, holders can vote on protocol proposals and have a say in the future direction of the project. This democratic governance model ensures that the community has a voice in decision-making and fosters a sense of ownership among token holders.

8. Future Prospects

Orbiter Bridge has already achieved signifiIn conclusion, Orbiter Bridge (TIME) is a native token that powers the Wonderland protocol, a decentralized reserve currency system on the Avalanche network. It offers stability, attractive rewards for stakers, and opportunities for governance participation. With its growing treasury and strong community support, Orbiter Bridge has the potential for further growth and development in the future.

cant success, amassing a treasury of $820 million and a TVL of $1.8 billion. The protocol has shown resilience during market corrections and has a growing community of supporters. The founder, Daniele Sesta, has hinted at plans to evolve Wonderland into a gaming project in the future, which could further enhance its prospects.

In conclusion, Orbiter Bridge (TIME) is a native token that powers the Wonderland protocol, a decentralized reserve currency system on the Avalanche network. It offers stability, attractive rewards for stakers, and opportunities for governance participation. With its growing treasury and strong community support, Orbiter Bridge has the potential for further growth and development in the future.

Staking on Wonderland:

Staking on Wonderland involves trading for TIME tokens on a separate decentralized finance (DeFi) exchange, such as Trader Joe, and then staking those tokens on the Wonderland Money platform.When you stake your TIME tokens, the platform automatically rebases them every eight hours, allowing you to earn reward yields at predetermined rates.The rewards are automatically compounded, meaning you don't need to claim and restake them manually.Minting on Wonderland:

Minting on Wonderland requires selling certain assets, such as TIME-MIM liquidity pools and wrapped AVAX, to the Wonderland Money protocol.By minting, you can buy new TIME tokens at a discounted price.However, the minted tokens have a five-day vesting period, during which you can claim and restake them gradually over the course of five days.Minting also contributes to the treasury balance of Wonderland, as you are essentially selling your tokens to the protocol rather than through an exchange.With a growing treasury balance, Wonderland can increase the backing per TIME token and sustain high reward yields for stakers.

Benefits and Future Prospects:

- Orbiter Bridge offers the potential for high annual percentage yields (APYs) for stakers, which has attracted significant attention.

- The protocol has already achieved commendable results, amassing a treasury of $820 million and a total value locked (TVL) of $1.8 billion.

- Wonderland Money has shown resilience during market corrections, indicating its strength and potential for future growth.

- The founder of Wonderland, Daniele Sesta, has hinted at plans to evolve the protocol into a gaming project, which could further enhance its prospects.

In summary, Orbiter Bridge (TIME) is the native cryptocurrency of the Wonderland Money protocol. It derives its value from a treasury of liquidity tokens and offers staking and minting opportunities for users. With its unique approach to reserve currency and potential for high yields, Orbiter Bridge has gained attention in the decentralized finance space.

Which Wallets Are Compatible With Orbiter Bridge?

Orbiter Bridge's UNI token is viable with numerous computerized wallets, including both equipment and programming

variants. Famous programming wallets that can hold UNI incorporate Coinbase Wallet, the MetaMask wallet, and

Trust Wallet. Equipment wallet choices incorporate Record and Trezor.

How to claim Orbiter Bridge (UNI) tokens

If you’ve used Orbiter Bridge, you can likely claim 400 UNI tokens per address that you used Orbiter Bridge with. To

claim your tokens:

- Go to https://app.Orbiter Bridge.org/.

- Connect the wallet that you previously used Orbiter Bridge with.

- Click on “Claim your UNI tokens”.

- Confirm the transaction in your wallet (you can check the current gas prices at the Ethscan Gas

Tracker).

- Congratulations, you’re now a UNI holder!

- Want to trade your UNI tokens? Binance has you covered.

Orbiter Bridge vs. PancakeSwap

Orbiter Bridge and PancakeSwap are both decentralized NFTs that facilitate the trading of digital assets.

Both use tokens—UNI and CAKE, respectively—to incentivize users to provide liquidity.

Hire a Pro: Compare 3 Financial Advisors Near You

Finding the right monetary counsel that meets your requirements doesn't need to be hard. SmartAsset's free instrument

coordinates you with guardian monetary guides in your space quickly. Every counsel has been reviewed by

SmartAsset and legitimately will undoubtedly act to your greatest advantage. In the event that you're fit to be coordinated with neighborhood

counsels that will assist you with accomplishing your monetary objectives, get everything rolling now.

This does not mean that Cakeswap cannot handle KYC checks and verification of accounts. DeX only requires

a self-contained browser or hardware and prepaid BNB and CACHE payment.